Overview

Updated 10/19/2022

This article outlines how FSLA Overtime Adjustments are automatically calculated through the Time Entry & Payroll Process for non-discretionary bonus payments.

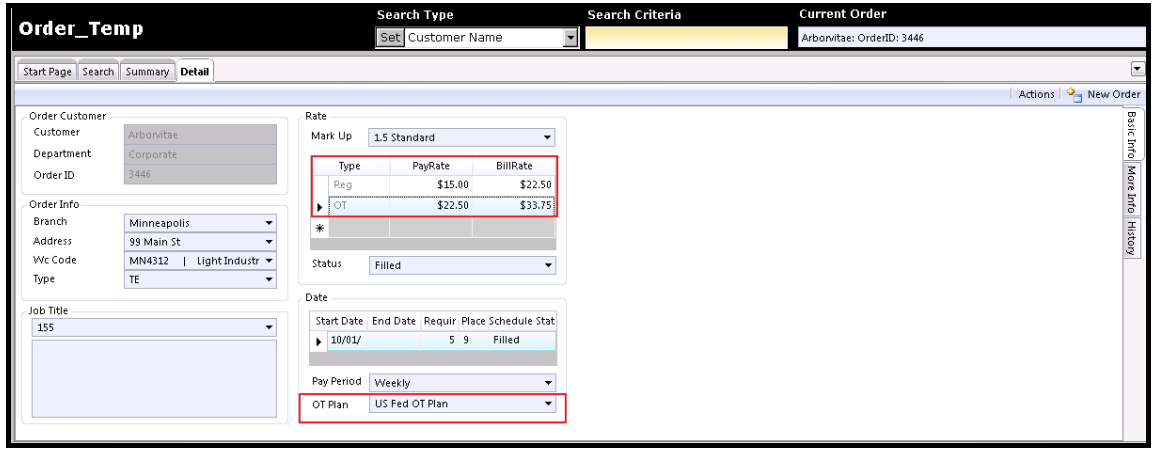

Reg & OT example:

Order detail showing the standard OT Plan "US Fed OT Plan" applied. Entering a Reg rate of $15.00 w/ the US Fed OT Plan will automatically generate/populate the OT pay rate x 1.5 -

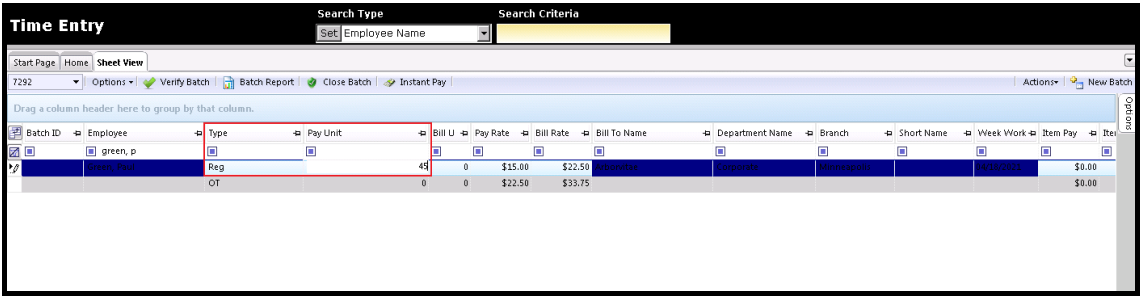

Within Time Entry - 45 hours added to Reg field for amount of Weekly hours worked by Employee -

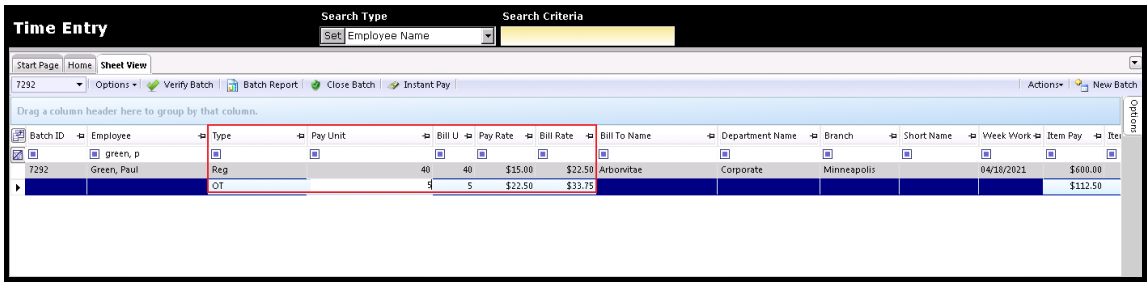

After Reg time entered, hit Tab key & the additional 5 hours will automatically be moved to the OT field -

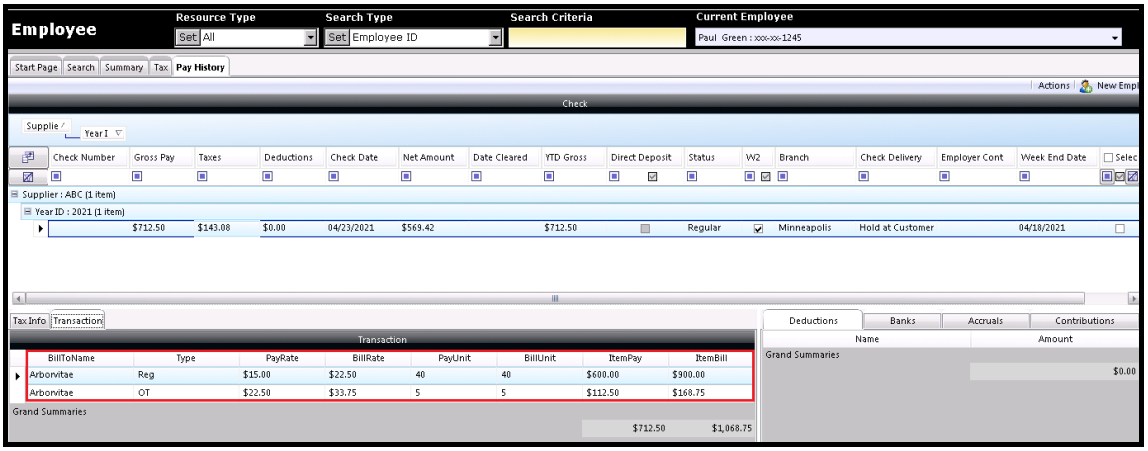

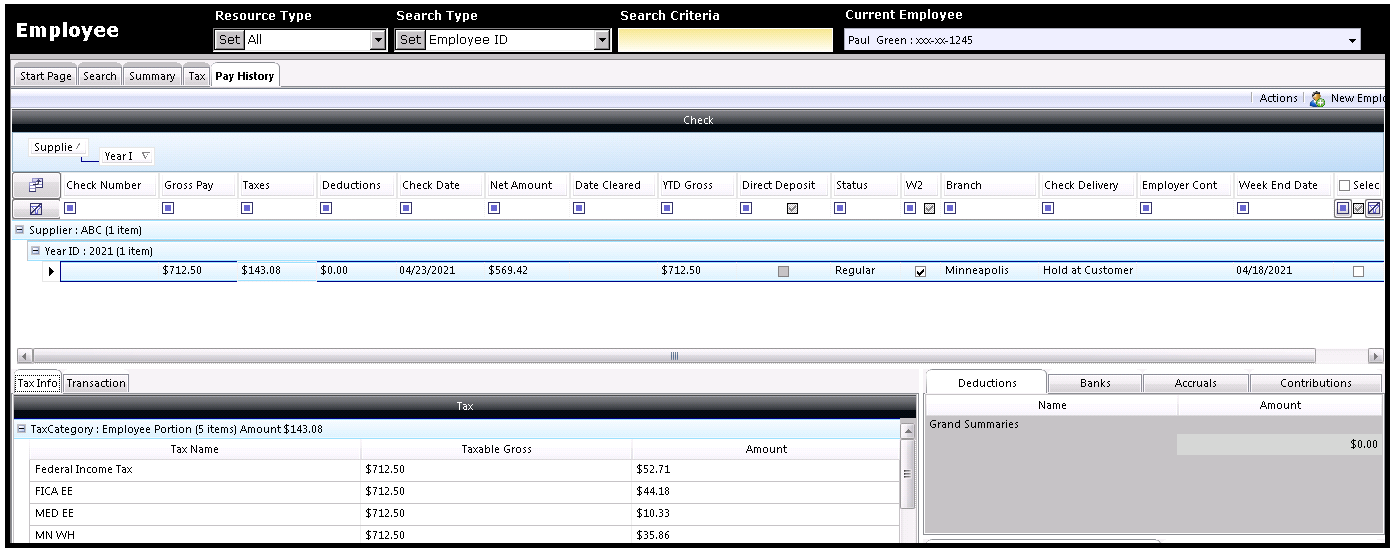

Payroll Processing separates Reg & OT pay units & adjusts gross amount accordingly -

Reg, OT & Bonus example:

Overtime (OT) is calculated at one and one-half times an employee's regular rate of pay. To obtain the new overtime rate of pay due to the bonus, an employer would take the new regular rate of pay and multiply it by 1.5

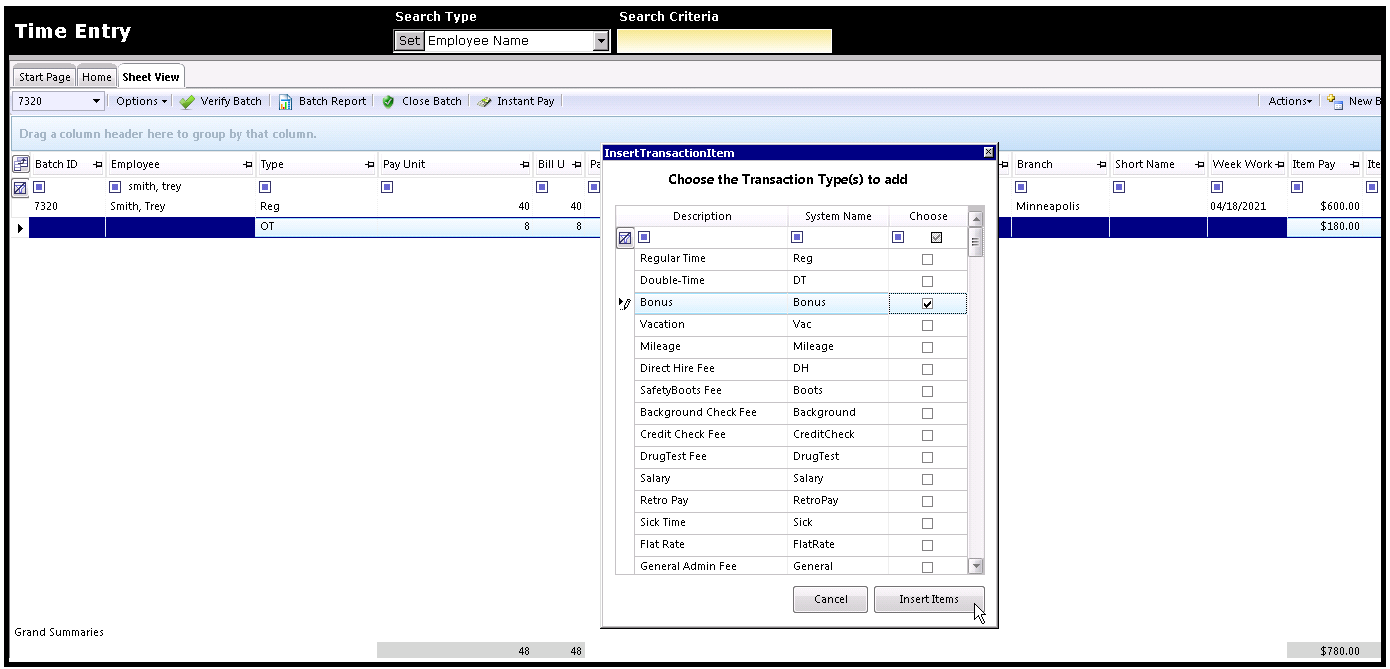

Bonus w/ OT rate is calculated within time entry. Populate the Reg & OT hours, then add the additional Bonus transaction -

Note: Ensure the Bonus transaction type is set correctly to Vertex Pay Code = Bonus & Is Discretionary Bonus = Unchecked-

Scenario

John makes $8 per hour and works eight hours per day, Monday through Friday. He is paid weekly. He received a production bonus of $9.20 and worked a total of 46 hours during the last workweek.

Actions

- HR determines the bonus should be included when calculating overtime because it was paid to motivate John to produce.

- HR defines the time frame as a workweek.

- Straight-Time Compensation is $320.00

- $8.00 per hour x 40 hours worked + $9.20 bonus = $329.20

- The new regular rate of pay for overtime purposes is calculated to be $8.20 per hour.

- $329.20 / 40 hours = $8.20

- The new weighted overtime rate of pay is calculated to be $12.10 per hour.

- New Reg $8.20 per hour x 0.5 = 4.1 / Original Reg $8.00 + 4.1 = $12.10

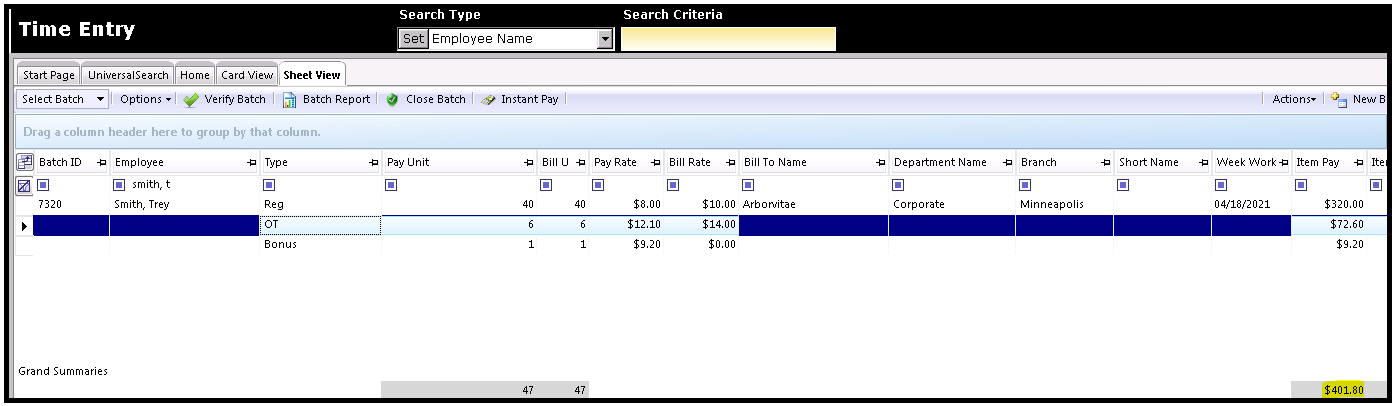

- The total earnings for John is $401.80

- $8.00 RR x 40 ST hours = $320.00

- $12.10 OT x 6 OT hours = $72.60

- $9.20 Bonus x 1 hours = $9.20

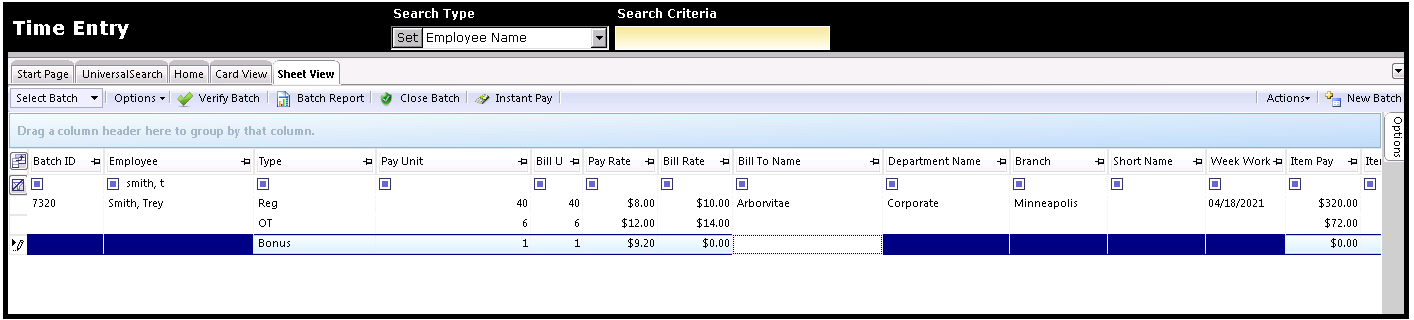

Insert the Pay Units & Rate for the Bonus -

Click out of the Bonus transaction line & into the OT transaction line for the new OT rate to auto-calculate based on the Bonus entry -

OT Rate changes from $12.00 to $12.10.

Comments

0 commentsPlease sign in to leave a comment.